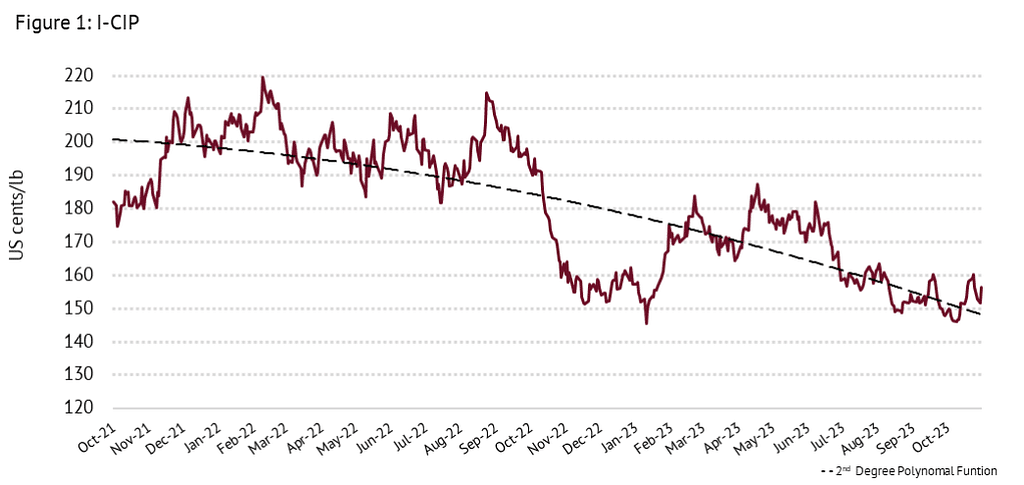

The International Coffee Organization’s (ICO) market report for October 2023 shows its Composite Indicator Price (I-CIP) fell by 0.8 per cent from September to October, averaging 151.94 US cents per pound.

The I-CIP fluctuated between 145.99 and 160.09 US cents per pound, with a median value of 151.58 US cents per pound. Volatility was stable at 6.3 per cent between September and October.

The Colombian Milds-Other Milds differential grew 38.5 per cents to 2.02 US cents per pound while Arbitrage, as measured between the London and New York Futures markets, widened by 13.7 per cent to 50.51 US cents per pound in October.

Global green bean exports for coffee year 2022/23 were down 5.5 per cent to 110.81 million bags compared to 117.28 million bags in coffee year 2022/22.

“The global macro-economic environment was not conducive to consumer confidence in coffee year 2022/23, with global inflation and interest rates in many of the key advanced economies high and rising, increasing the cost of living and thus reducing disposable income levels for a very large section of the world,” the ICO says in its report.

“The drop in global exports of green beans in coffee year 2022/23 may therefore lie more with logistics/the supply chain than the economy and actual consumption of coffee.”

Shipments of the Other Milds decreased by 12.1 per cent to 22.11 million bags in coffee year 2022/23, down from 25.16 million bags in 2022/21.

Exports of the Colombian Milds dropped by 11.2 per cent, from 12.14 million bags to 10.77 million bags in the past 12 months.

However, Green bean exports of the Robustas for coffee year 2022/23 rose 2.6 per cent to 43.76 million bags, up from 42.66 million bags.

“The September 2023 exports represent the lowest September volume for the Robustas since the 2.58 million bags shipped in 2012, and were a result of the 43.4 per cent decrease in exports from Vietnam, the world’s largest producer and exporter of the group, which only shipped 0.81 million bags – the lowest September exports since 2008 (0.79 million bags),” the ICO says.

For coffee year 2022/23, South America’s exports of all forms of coffee decreased 11.0 per cent, from 56.83 million to 50.59 million bags.

Exports of all forms of coffee from Africa fell by 1.4 per cent to 13.53 million bags in coffee year 2022/23 compared to 13.73 million bags.

Mexico and Central America’s exports of all forms of coffee were down 3.1 per cent – from 15.78 million bags to 15.3 million bags.

Exports of all forms of coffee in Asia and Oceania were down 0.9 per cent, down to 43.56 million bags from 43.95 million.

Total exports of soluble coffee dropped by 5.7 per cent, from 12.16 million bags to 11.47 million. For coffee year 2022/23, soluble coffee’s share of the total exports was 9.3 per cent – the same as the year before.

For 2022/23, roasted coffee exports were down 16.0 per cent to 0.71 million bags, from 0.84 million bags in 2021/22.

World coffee production decreased by 1.4 per cent, year-on-year, to 168.5 million bags in coffee year 2021/22; however, it is expected to bounce back by 1.7 per cent to 171.3 million bags in 2022/23.

World coffee consumption increased by 4.2 per cent to 175.6 million bags in coffee year 2021/22. It is expected to increase by 1.7 per cent to 178.5 million bags in 2022/23.

As a result, the ICO says the world coffee market is expected to undergo another year of deficit, with an estimated shortfall of 7.3 million bags in coffee year 2022/23.

For more information, click here.

The post I-CIP volatility remains stable: ICO October report appeared first on Global Coffee Report.